Embarking on an entrepreneurial journey

in Canada unlocks opportunities for personal growth, financial independence,

and the ability to shape your own career path. With the freedom to set your

rates, define your work schedule, and tailor your services to meet your vision,

it’s no surprise that Canada boasts over 1.21 million employer businesses

(Statistics Canada, 2021).

However, alongside the exciting

possibilities come essential administrative steps that every entrepreneur must

navigate. This guide serves as your roadmap, outlining the key processes

involved in registering a business in Canada and providing the information you

need to navigate this crucial first stage.

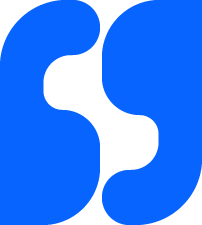

Navigating

Business Structures in Canada: Choosing the Right Path

Launching a business in Canada requires

selecting the appropriate legal structure, impacting areas like liability,

taxation, and administrative requirements. While numerous options exist, this

guide focuses on the three most common: Sole Proprietorship, Partnership, and

Corporation.

Sole Proprietorship:

●

Simplest

structure: Operates as a single individual, blending your personal and

business identities.

●

Easy

setup: No formal registration required, minimal administrative burden.

●

Unlimited

liability: You are personally responsible for all business debts and

obligations.

●

Taxation: Business

income directly taxed on your personal return.

●

Suitability: Ideal for

small, low-risk ventures and solopreneurs.

Partnership:

- Joint venture: Two or more individuals share ownership, management, and liability based on their defined contributions.

- Formalization: Can be established verbally or documented in writing. Registration may be required in some cases.

- Shared liability: Partners personally share responsibility for business debts and obligations, based on their ownership percentage.

- Taxation: Business income reported and taxed on each partner’s personal return.

- Suitability: Works well for co-founded businesses with shared ownership and management responsibilities.

Corporation:

- Separate legal entity: Creates a distinct entity from its owners, with its own assets, liabilities, and tax obligations.

- Formal establishment: Requires registration with government agencies.

- Limited liability: Owners generally shielded from personal responsibility for business debts (exceptions may apply).

- Taxation: Corporations pay separate corporate taxes on their profits, and owners may face additional taxes on dividends received.

- Suitability: Well-suited for larger businesses seeking limited liability, raising capital, and attracting investors.

Registering Your Business in Canada: Navigating the Process

Understanding the business registration process in Canada is crucial for aspiring entrepreneurs. This guide outlines the general steps involved, emphasizing that specific requirements may vary depending on your chosen business structure and location.

Key Considerations:

●

Structure: The

registration process differs between sole proprietorships, partnerships, and

corporations.

●

Location: Registering

provincially limits operation to that province, while incorporating federally

allows nationwide operation (with potential additional requirements).

Sole Proprietorships and Partnerships:

- Simpler process: Generally, no formal registration required unless operating under a name other than your own.

- Provincial rules: Some provinces may have specific regulations. Verify with your local authorities.

Corporations:

- Formal registration: Required at either the provincial or federal level.

- Information needed: Prepare documentation such as:

- List of directors and officers

- List of shareholders and their ownership percentages

- Contact information for all parties

- Registered office and agent for service location

- Provincial registration:

- Each province has its own registry system. Check for specific instructions and registration options (e.g., online, in-person).

- Some provinces have additional requirements (e.g., Alberta’s registry office or third-party registration services).

- Federal incorporation:

- Similar process to provincial registration.

- Use Corporations Canada to initiate the process.

- Requires the same information as provincial registration.

- Nationwide operation: While federal incorporation allows you to operate anywhere in Canada, additional provincial compliance may be needed.

- Name protection: Federal corporations benefit from enhanced name protection compared to provincial counterparts.

●Provincial registration:

- Formal registration: Required at either the provincial or federal level.

- Information needed: Prepare documentation such as:

- List of directors and officers

- List of shareholders and their ownership percentages

- Contact information for all parties

- Registered office and agent for service location

Incorporation Fees in Canada: A Quick Reference

Understanding the cost of incorporating your business in Canada is crucial for informed decision-making. This table provides approximate government fees for incorporation, excluding any additional expenses such as legal services.

| Location of Incorporation | Approximate Cost | Name Fee |

|---|---|---|

| British Columbia | $350 | $31.50 |

| Alberta | $450 | $30 |

| Saskatchewan | $265 | $60 |

| Manitoba | $300 | $49 |

| Ontario | $300 | $60 |

| Quebec | $367 | $50 |

| New Brunswick | $260 | $30 |

| Nova Scotia | $200 | $70 |

| Prince Edward Island | $255 | Included |

| Newfoundland and Labrador | $300 | $300 |

| Yukon | $345 | Included |

| Canada (Federal Incorporation) | $200 | $30 |

Choosing and Registering Your Business Name in Canada

Selecting a distinct and memorable name is crucial for establishing your business identity. This guide outlines the key steps involved in choosing and registering your business name in Canada, while highlighting important distinctions between trademarks and corporate names.

Key Considerations:

- Name Selection:

- Distinctiveness: Ensure your name stands out from competitors and existing businesses.

- Legal Element: Include “Ltd.”, “Inc.”, or “Corp.” for corporations.

- Governmental Affiliation: Avoid names suggesting official support or control.

- Uniqueness: Verify availability through online searches and business records.

- Trademarks vs. Corporate Names:

- Trade Names: Used by sole proprietorships or other non-incorporated businesses (lesser legal protection).

- Corporate Names: Assigned during incorporation (stronger legal protection).

Registration Process:

- Sole Proprietorship (Trade Name):

- Availability: Verify through provincial online portals or NUANS Report (~$14).

- Registration: Complete online through provincial registry (fees vary, e.g., $10 in Alberta).

- Corporation:

- Name Selection: Choose during incorporation process.

- Automatic Protection: Federal incorporation offers nationwide name protection.

Additional Considerations:

- GST/HST Number: Required for businesses exceeding $30,000 quarterly revenue.

- Registration: Use your existing Business Number (acquired during incorporation or through CRA registration).

- Non-registered Sole Proprietorships: Register for a Business Number before registering for GST/HST.

Resources:

- NUANS Canada: https://ised-isde.canada.ca/site/nuans-corporate-name-trademark-reports/en

- Canada Revenue Agency (CRA): https://www.canada.ca/en/revenue-agency.html

- CRA Business Registration Online: https://www.canada.ca/en/services/taxes/business-number.html

Business Licenses, Permits, and Banking in Canada: Navigating the Essentials

Launching a business in Canada involves understanding legal requirements beyond choosing a structure. This guide focuses on obtaining necessary licenses, permits, and setting up a business bank account.

Business Licenses and Permits:

- Municipal Requirements: Contact your local municipality (city/town) to determine local licensing requirements, even for home-based businesses.

- Business Property: Owning or renting property for business operations may necessitate additional permits (e.g., signage, food service).

- Zoning and Building Permits: Depending on your industry and location, zoning and building permits might be required from your municipality or province.

- Environmental Permits: Businesses impacting the environment may need federal or provincial environmental permits.

- BizPaL Tool: Consult your local BizPaL, an online resource providing comprehensive lists of relevant permits and licenses in your jurisdiction.

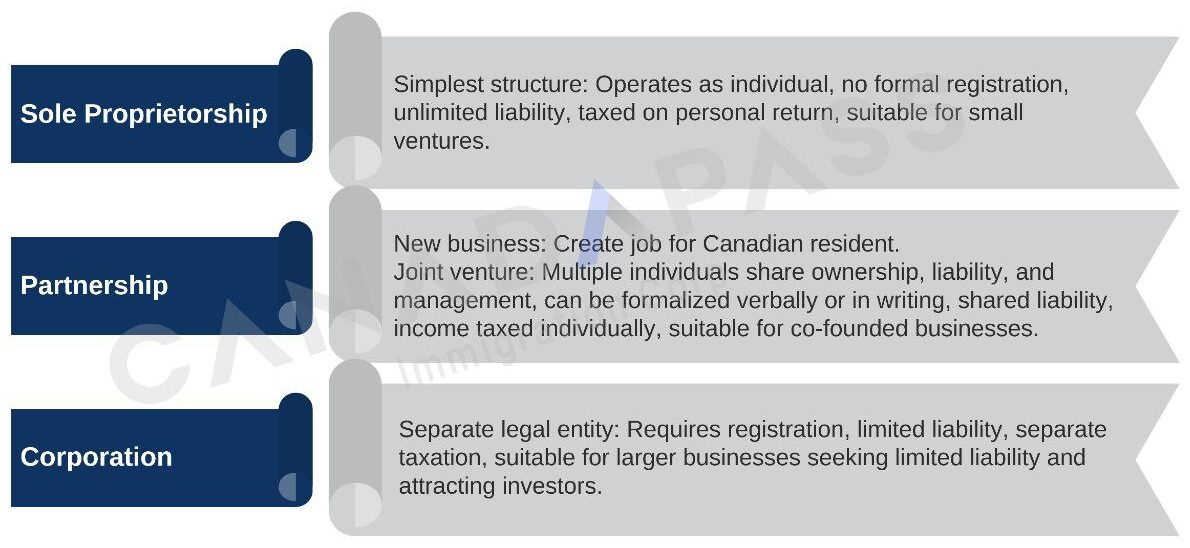

Opening a Business Bank Account:

- Sole Proprietorship: Not strictly required, but recommended for financial clarity and record-keeping.

- Corporation: Mandatory, as the business entity is separate from the owner financially.

- Required Documents: Proof of incorporation, business number, director information (names, SINs), and other official documentation may be requested by banks.

- Seamless Process: With necessary documents, setting up a business bank account with a banking professional is generally straightforward.

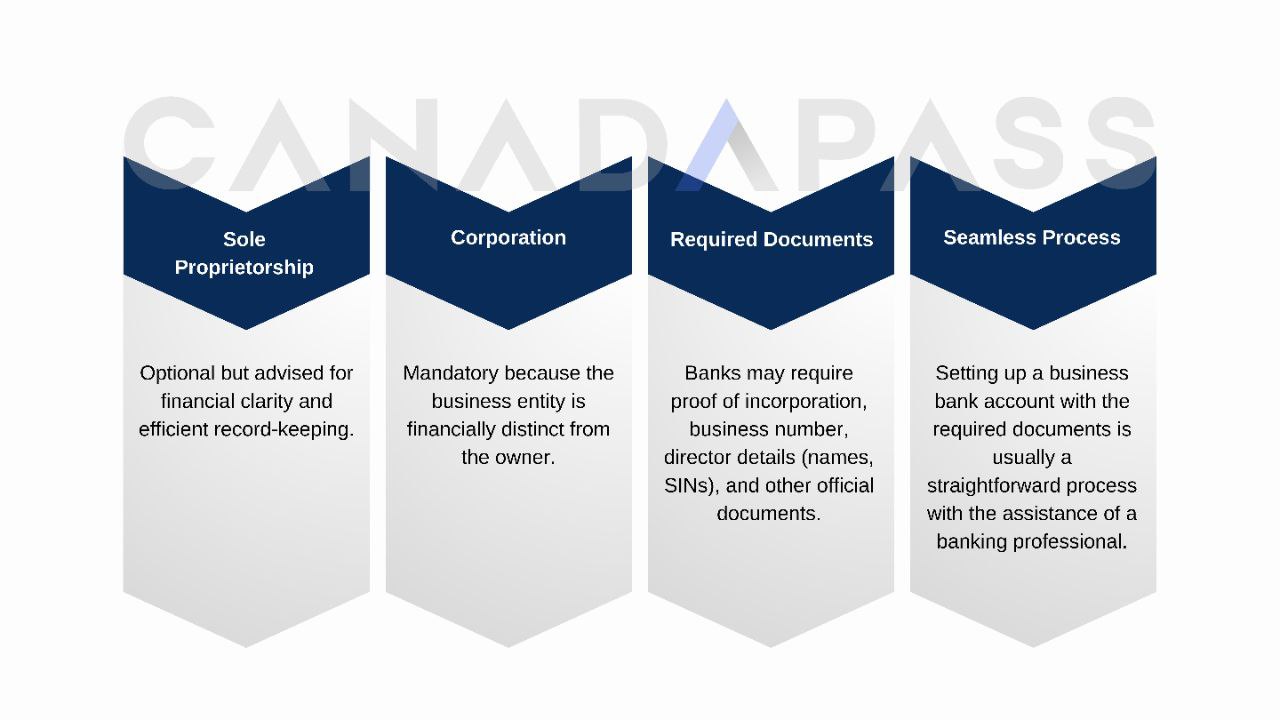

Do I Need a Business Credit Card in Canada?

While not mandatory for every entrepreneur, business credit cards offer several potential benefits:

Enhanced Expense Tracking: Separate your personal and business expenses for clear accounting and easier tax filing. Eliminate the need to sort through receipts with mixed personal and business purchases.

Professionalism and Convenience: Signal to potential partners and suppliers that you take your business seriously and manage finances strategically. Leverage convenient contactless payments and online transactions.

Potential Rewards: Depending on the card, you might earn points, cash back, or other rewards on business spending, offering potential cost savings or additional benefits.

Building Credit History: Responsible use of a business credit card can help establish and improve your company’s credit score, potentially benefiting future financing opportunities.

Navigating Business Registration in Canada: FAQs Answered

Q: How do I register my business in Canada?

The process depends on your chosen structure:

- Sole Proprietorship or Partnership: No formal registration required unless operating under a name other than your own.

- Corporation: Registration necessary. Options include provincial registries or online services like Ownr. Fees apply.